MEDICAL DEBT CREDIT REPORTING CHANGES

How the New Changes Affect Getting a Mortgage

MEDICAL DEBT CREDIT REPORTING CHANGES

Credit Reporting of Medical Debt will be changing beginning July 2022

What is Everyone Saying?

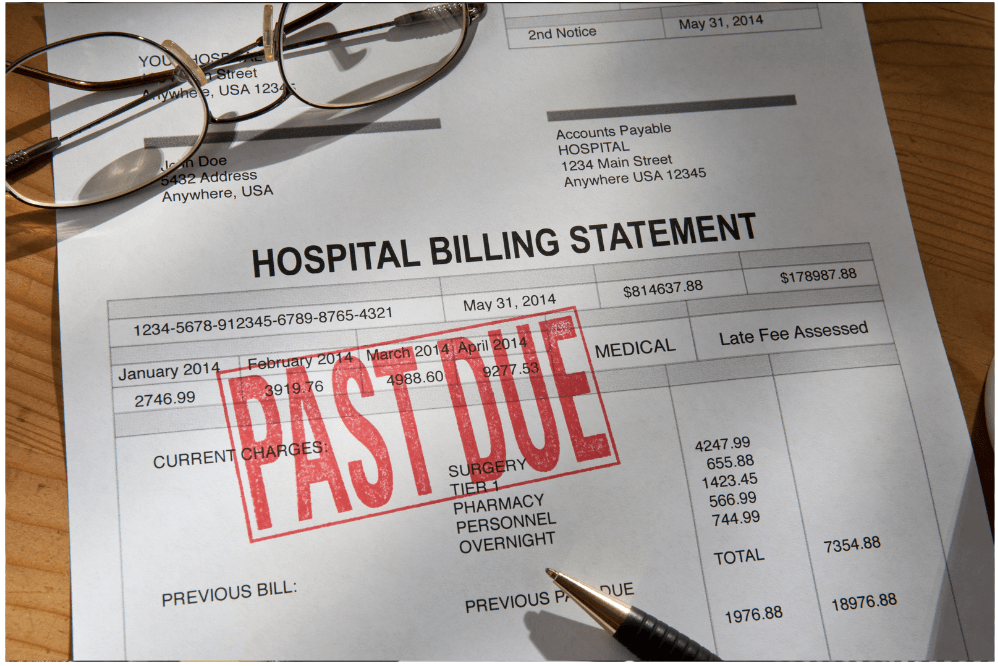

There is a big change coming this July regarding the reporting of medical debt. This new policy can be helpful for people seeking credit who have been held back in the past due to medical debt affecting their credit scores.

One of the explanations given by Vice President Harris for taking this new approach, was that so many people have been rushed to the hospital in the past for things like their appendix bursting or taking a nasty fall and they are still paying off the bills years later. That debt stays on their credit report.

Furthermore, there are many Americans who will forgo getting medical treatment for themselves or their loved ones, due to worrying about the medical debt and how it will affect them.

In looking at a few different studies, the numbers for what Americans owe for medical debt are staggering. This new program might just be a breath of fresh air consumers need to recover from the financial woes associated with owing such debt.

The CFPB (Consumer Financial Protection Bureau) released a report earlier this year claiming about $88 billion of medical debt is on credit reports in this country.

And according to a new KFF analysis of government data, nearly 1 in 10 adults – roughly 23 million people – owe for medical debt.

JAMA published a research paper at the end of last year, mentioning that collection agencies held $140 billion in unpaid medical debt. (This debt didn’t include legal fees, wage garnishments, or credit card debt to pay bills, in their figure.) It showed patients have outstanding medical debts, including individuals who do not have credit cards or bank accounts. The paper found that about 18 percent of American’s hold medical debt that is in collections. The researchers also reported that, “between 2009 and 2020, unpaid medical bills became the largest source of debt that Americans owe collections agencies”.

Neale Mahoney, a health economist at Stanford University and the paper’s lead author said that when you think about it, Americans getting are phone calls, letters and knocks on the door from debt collectors, more often than not over medical bills.

According to a report by the American Journal of Public Health, the majority of people who filed for bankruptcy between 2013 and 2016 had a least some medical expenses contributing to their financial distress.

WHY ARE THESE CHANGES NEEDED?

In a recent Forbes article, the changes may make it easier for people who have dealt with the burden of unforeseen and unexpected medical bills to rebuild their credit. The past accounts in collections can dramatically decrease a person’s credit score which makes it harder to get new credit with reasonable interest rates.

Finance Expert and Youtuber Jasmine (Jazzy Mac) McCall explained it like this, medical debt is an unexpected financial burden and is not a true reflection of a person’s willingness or their ability to pay back a debt.

Sarah Kliff and Margo Sanger-Katz’s joint article in the New York Times, reflects this same sentiment when it mentioned, that medical debt is unlike other kinds of debts because people often cannot choose whether to incur it. A poorer person may choose to buy a less expensive car than their rich neighbor, but if she has a heart attack and needs surgery, she will get a bill just like her neighbor.

McCall further stated, that often even a consumer with insurance doesn’t know exactly what they are going to be left owing, and sometimes by the time they do realize what they are responsible for, the medical bill may be overdue and on its way to collections.

These accounts that have been turned over to collections but have since been paid, stays on a consumer’s account for about 7 years after it gets sent to collections.

And to make matters worse, McCall gave further examples in her interview with Forbes, that often the consumer gets charged with excessive charges due to errors in medical billing including coding.

A review of online articles shows a common reason in the need for change, being that a consumer is often coerced into paying medical debt with the threat of it appearing on their credit report if they don’t agree to the terms, thus affecting their over-all credit score.

WHAT CAN WE ANTICIPATE FROM THESE CHANGES?

In reviewing the way things have worked in the past, consumers who did not pay off their medical debt in a timely manner, but eventually paid it off, still had the residue on their credit for 7 years. Many of these people paying off these debts over time, didn’t know that the collection accounts do not naturally fall off after being paid in full.

The great news with the new change, is that most consumers who have medical debt won’t be penalized by having this appear on their credit report.

A consumer still needs to be privy that just because the medical debt doesn’t appear on their credit report, doesn’t mean that they don’t owe the debt. And helping the consumer with medical debt reporting doesn’t remove the lingering issue of consumers being able to afford to pay their health care. This new change will not eliminate medical debt, but it will eliminate some of the consequences associated with it.

In an interview by NPR of Attorney Jenifer Bosco, of the National Consumer Law Center (a non-profit organization that advocates for economic security for low-income people), Bosco stated that the upcoming changes are going to help consumers by changing the rules around in what manner the medical debt is reported, as well as how the 3 major credit bureaus are going to drastically reduce how much medical debt goes on credit reports. She expressed the great news is that most consumers who have medical debt, won’t be penalized by having it appear on their credit report. And any medical debt that has been paid off will no longer be included in the credit reports even if it has been on the consumer’s report for years.

Furthermore, Forbes stated that there will be a buffer of one year before medical debt in collections will appear on a consumer’s credit report. This will give the consumer time to negotiate for a mutually- agreeable payment or pay off their medical debt to give the consumer time to fix the problem.

Furthermore, beginning in the first half of 2023, the 3 consumer credit reporting agencies will no longer include medical debt in collections under $500 on credit reports. The 3 large credit reporting agencies report that this will remove nearly 70% of medical collection debt tradelines from consumer’s credit reports.

THE NO SURPRISE ACT

When medical debt shows up on credit reports and credit scores, it hasn't been shown to be predictive of how creditworthy people are because it's not like a regular purchase. It’s a different entity. And sometimes that's even a collection strategy — with debt collectors knowing that people want to clear this off of their credit reports and [so they] will pay it to resolve the medical debt.

It is great news that most consumers who have medical debt won't be penalized by having this appear in their credit report.

Below are a few examples of how various government agencies will be dealing with the upcoming changes.

The Consumer Financial Protection Bureau (CFPB) issued a bulletin to debt collectors and credit reporting agencies about the new protection against surprise billing. They reminded debt collectors and credit reporting agencies that they have to be very careful in making sure they do not try and collect debts that are prohibited by the No Surprises Act.

The Department of Veterans Affairs took a major step in protecting veterans and their families by announcing a change to when it will report information on outstanding medical bills to consumer reporting companies. With the new VA rule, the agency will only report a medical bill after all other collection efforts have been exhausted, largely eliminating credit reporting used as a coercive means of debt collection. The VA has determined the individual responsible is not catastrophically disabled or entitled to free medical care from the VA and, the outstanding debt is over $25.00.

The Veterans [Health] Administration also announced that it's going to stop reporting about 90% of the medical debt that they had previously been reporting. Furthermore, they are working on streamlining the process for people to use to have their medical debts forgiven.

The Department of Health and Human Services announced that they are going to aggressively enforce the No Surprises Act to help protect consumers from many kinds of surprise billing.

The Federal Housing Finance Agency announced that it's looking at the credit models that Fannie Mae and Freddie Mac use for lending. With this new move, medical debt won't be counted against consumers in the way it had been in the past.

LEARN MORE:

Below are copied links to the Government’s Consumer Finance pages if you would like to learn more in certain areas.

CFPB New Veteran’s Affair rule

If you’re struggling with mounting medical bills, there are resources available to assist you.

- Learn more about your rights under the No Surprises Act by visiting the Centers for Medicare and Medicaid Services or by contacting the No Surprises Help Desk at (800) 985-3059.

- Visit Ask CFPB to find out what you should know about debt collection and credit reporting if your medical bill was sent to collections.

- You can submit a complaint to the CFPB online or by calling (855) 411-CFPB (2372) if you are having an issue with debt collection. We’ll work to get you a response from the company.

- For questions about medical and pharmacy copayment debt , veterans can contact VA’s Health Resource Center at (866) 400-1238.

What does this mean for anyone helping someone purchase a home or, as a consumer, you purchasing a home and needing a mortgage?

BOTTOM LINE:

This change alone, can nudge the credit score higher, making the difference

in getting a mortgage or not.

Palm Harbor Mortgage Advisors

Palm Harbor Mortgage Advisors is a family owned and operated business for over 20 years with a combined 43 years of industry knowledge. We are located in Palm Harbor, Florida. We have in-house loan processing with wife’s company making a huge difference by removing obstacles and barriers throughout the loan process to get you to the closing table on time.

We specialize in mortgages for first-time homebuyers, conventional home mortgages, self-employed borrowers, investors, condos, refinance loans (refis), reverse mortgages, Jumbo Loans, FHA Loans, VA Loans, and USDA Loans.

Please contact us to see how we can help by calling us at 727-542-3357 or completing a loan application here jameslstojak.zipforhome.com.

NMLS: 242917/1948608